A CEO told me this week they believed their business wasn’t cut out for “inbound” growth.

To date, they’ve been able to drive $5M in ARR from 700 customers across multiple markets and industries, through outbound and their partner channel network. And as it stands today the business sees an immaterial amount of volume from direct sources, but nothing that’s been sustainable or repeatable.

At this point, about 7 minutes into the call, I’m hooked. Not because I’m nodding my head in agreement, but moreso because I’m intrigued that this exec believes “inbound” isn’t a channel that will support this business.

I’ll be the first to say, no one is immune to the difficulties that have hit all of SaaS in the last several quarters. But the fact that this company has seen most of its growth through outbound in a climate where outbound is under the biggest pressure cooker and seeing diminishing returns across tens of thousands of SaaS orgs tells me there might just be more to uncover.

Let’s say your org is similar. Here’s how I worked through the rest of this discovery call with the CEO.

Let’s start with the foundation.

How are you defining “inbound”?

Likely to no one’s surprise, a lot of marketing terms are often misused and undefined. So it’s never a bad idea to make sure your manager, your peers, or even the CEO and yourself are talking about things the same way.

This CEO heavily associates PPC (Google Ads) as Inbound. And come to find out, they haven’t found a lot of success there. Taking this a step further, a large percentage of their business comes from EMEA – a region comprised of more than 56 languages, a mix of cultural backgrounds, and varying degrees of tech adoption for this software in particular. That’s a lot to consider when just broadly waving a hand and saying, “inbound doesn’t work for us”.

Firstly, all of us here of course know that Google Ads does not in and of itself equal Inbound. But it’s a good reminder that more often than not, your CEO isn’t a marketer by trade.

But followed by a close second—localization is an under-prioritized lever to ensure your marketing dollars are working for you. And when being used efficiently, Google Ads really should only be used as a lever to bid on high intent keywords (those most likely to convert) as Search is a mechanism for capturing existing demand in the market. Which at best will only be 5% of your TAM.

But before I get ahead of myself…

How are you measuring inbound?

We all know this can be dicey territory and trust me I’ve seen alllll the models. You’ve got some CEOs ready to die on the hill of first touch attribution, while others are ok with last touch (for this stage of their growth journey). Others are really about the W or the U shaped models. Others are taking the more custom approach with a balance of self-reported when available, or last touch when not.

And I have one client who’s spending enough to warrant and validate a MMM model. (Pranav explains it best.)

I’ll do a dedicated post on attribution soon, but for now, just know the method to your madness and be able to tell the data story from multiple angles. Just because the company might choose to manage up to the board on first touch, doesn’t mean that’s the only data view you, as the marketer, should have access to and leverage daily.

For example, this company is on a first-touch attribution model….so of course they’re not “seeing success” with Google Ads. They’re basically short-changing how they’re telling the data story.

What is your ICP?

Having a clear understanding of who you’re selling to and finding the most success with is helpful for every single thing you’ll ever think about and ship for your brand. For me, understanding ICP at this stage is my anchor for ideation. This helps me get into the mindset of the buyer.

- Who are they?

- What are some of their pain points?

- What would help them do their jobs better/easier/faster?

- Where do they most often spend time?

- What level of agency do they likely have inside of their organization?

Now onto the fun stuff. After spending just 30 minutes with this client I was able to demystify the CEOs opening statement, “maybe this business just isn’t cut out for inbound growth.”

Here’s how I thought about what growth levers could look like for this business. (In full transparency, this is part of the transcript from our call.)

We should start by broadening the lens of what’s considered “inbound”. You had mentioned at the top of the call you have 700+ customers. Do you have a referral program?

Small tangent.

Channel saturation, more competition, and platform openness are getting worse. This means fewer opportunities and worse customer acquisition economics in the opportunities available. A few of the recent trends:

Facebook, Google, Amazon advertising dominance - 40% of all venture capital, and 70% of a company’s digital ad budget is spent on these 3 platforms.

Apple is killing user advertising IDs - Apple has recently killed user advertising ID’s. Google has similar plans. This means performance marketers will have less visibility into what is working, reducing ability to optimize cost effectiveness.

Google Search decreasing real estate - Google continues to decrease the prominence and presence of organic search results in addition to decreasing the need for a user to click out of the search results.

As these marketing channels become more crowded and less cost effective, the importance of Word of Mouth becomes even more critical to drive user growth.

- Yousuf Bhaijee

Source: Reforge

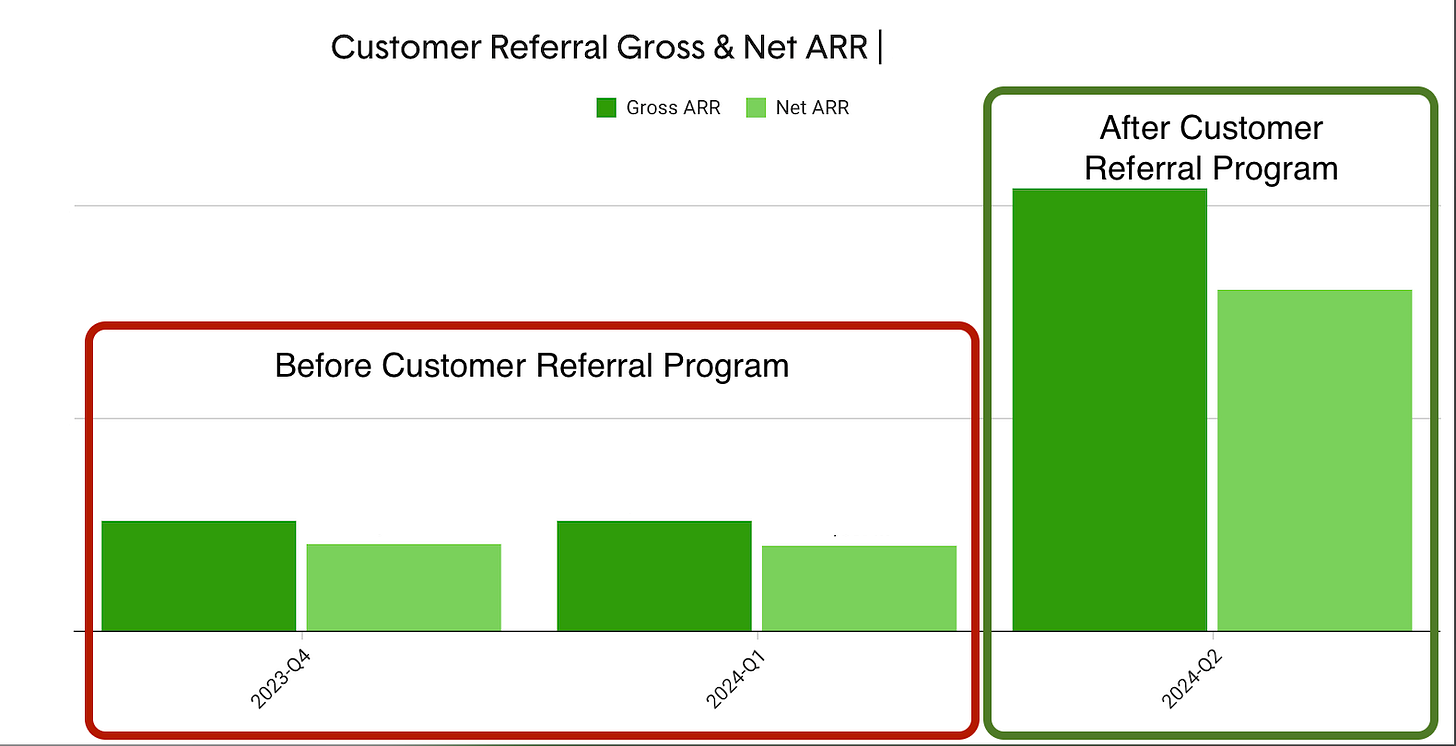

And there’s no one more powerful to spread that word of mouth than current, happy customers. Which is why my mind goes immediately to referral. Another client of mine recently stood up a customer referral program and 4x’ed their Gross ARR in the first quarter.

Here’s a Figma you can steal for inspiration on how to stand up the backup ops for your own customer referral program.

Secondly, there’s a brand awareness and market knowledge deficit for this brand. General rule of thumb, 70% of your media budget is geared towards demand creation tactics, and 30% (or less) demand capture (e.g. those Google Ads mentioned at the top). If most people don’t understand the problem you’re solving and your unique POV for how you’re solving it, there won’t be much demand to capture in the first place. CEO immediately starts nodding his head and saying they’ve never spent time telling their story to their prospects.

The brand today doesn’t have a muscle for creating a rented audience to share their story + credibility + authority, converting them to owned land, and then monetizing (turning them into customers). Definitely worth exploring alongside a purely paid strategy.

And if setting sails on growth, it’s worth getting into the discussion of what markets you’re most bullish on. Is now really the time to try to expand to a new market in North America, or have you created a strong wedge and name for yourself in EMEA territory so worth doubling down?

This led to an interesting back and forth where the decision isn’t as obvious as it might’ve felt at the top of the call and quickly becomes something worth prioritizing in the research/audit phase. New markets isn’t always the answer for growth. I’ll be working to solidify a framework for how I think about new programs, new markets, etc. vs doubling down in the coming weeks.

All to say, the CEO ended the call saying his eyes had been opened. He’d definitely brought some preconceived notions into the call, but left more open-minded and optimistic about what Inbound and growth in general could look like for the business.

Onward.