Maybe it’s all in what you’re used to. In fact, I’m sure it is. I grew up with two, hardworking, blue collar parents—a mechanic, and a cosmetologist.

We lived in a town where neighbors looked after neighbors, and the street lights turned off by 9. A town where you have to buffer a few hours for a trip to the grocery store because you’ll run into everyone you’ve ever known and inevitably have to catch up. And unfortunately, a home that didn’t talk openly about money or finances.

Of course I wasn’t entirely naive. I knew my parents worked incredibly hard and we were always very careful with how we spent money. Not that I ever went without, but that we were firmly blue collar.

This childhood environment must have helped to shape my belief that employment under a W-9 would provide the most stability and security for my own career one day. A career in which I could help give back to my parents, and build generational wealth for my children and theirs.

Fast forward to post-college (as a first generation graduate) without a clue of what I really wanted, but I knew if I could land a W-9 full time gig, I’d be set.

Why in the world did I believe this? And better yet, why did I believe it for so long?

8 years to be exact. That’s how long I’ve held a W-9. And honestly no other route really crossed my mind until 2022. For those of us in tech we know what 2022 meant to us.

Layoffs.fyi has reported nearly 500,000 tech workers have been laid off since 2022.

Gulp. Everything I’d assumed about stability and security (regardless of my performance at work) was wiped in this new reality. And it was then that I started to actively make a plan for how I wanted to build the career I’d be proud of. One that allowed me to:

Be an active mom and partner.

Take on multiple short, medium, and long term projects.

De-risk my income by diversifying my revenue streams.

Build a path to early retirement.

So what is solopreneurship anyway

Solopreneurship is about building a growth strategy centered around your brain + your skillset—and you guessed it, solo.

To be successful:

- You likely thrive in building something significant from your talents

- You prefer not to deal with overhead costs or complexity of managing a team

- You are self-motivated and want to maintain complete control over your business

- You have a clear, single service or product idea you’re passionate about

For me, this concept explained by Elena Verna of turning your brain into your product to ‘build a predictable, sustainable, and competitively defensible growth model’ was the final push I needed to figure this out for myself.

And I’m not alone. According to this article, the U.S. is expected to have 86.5 million people who’ve opted to leave the traditional nine-to-five by 2027. This is more than just a fad, it’s a movement.

By diversifying your revenue streams, you’re also de-risking your income. But if you’re bound to a W-9, oftentimes your company has you contractually committed to a non-compete that’s as strict as your local librarian when you finally turn in those overdue books. 👀 Some stating verbatim that you are not permitted to receive income from any other sources while employment is active.

Example 1 - pretty standard non-compete language

Example 2 - a clause specifically banning all moonlighting

Let’s not get this twisted. Language protecting companies and employees from swapping trade secrets amongst competitors—totally respect this. Banning an employee from providing marketing services outside of their nine-to-five though, overkill. This W-9 model and restrictions stunts your growth and gives you a pretty firm ceiling in terms of earnings, how you structure your days, the projects you work on, etc.

Ok ok…you get it. I’m a fan of this solo movement. So, how do you make it happen?

Getting started

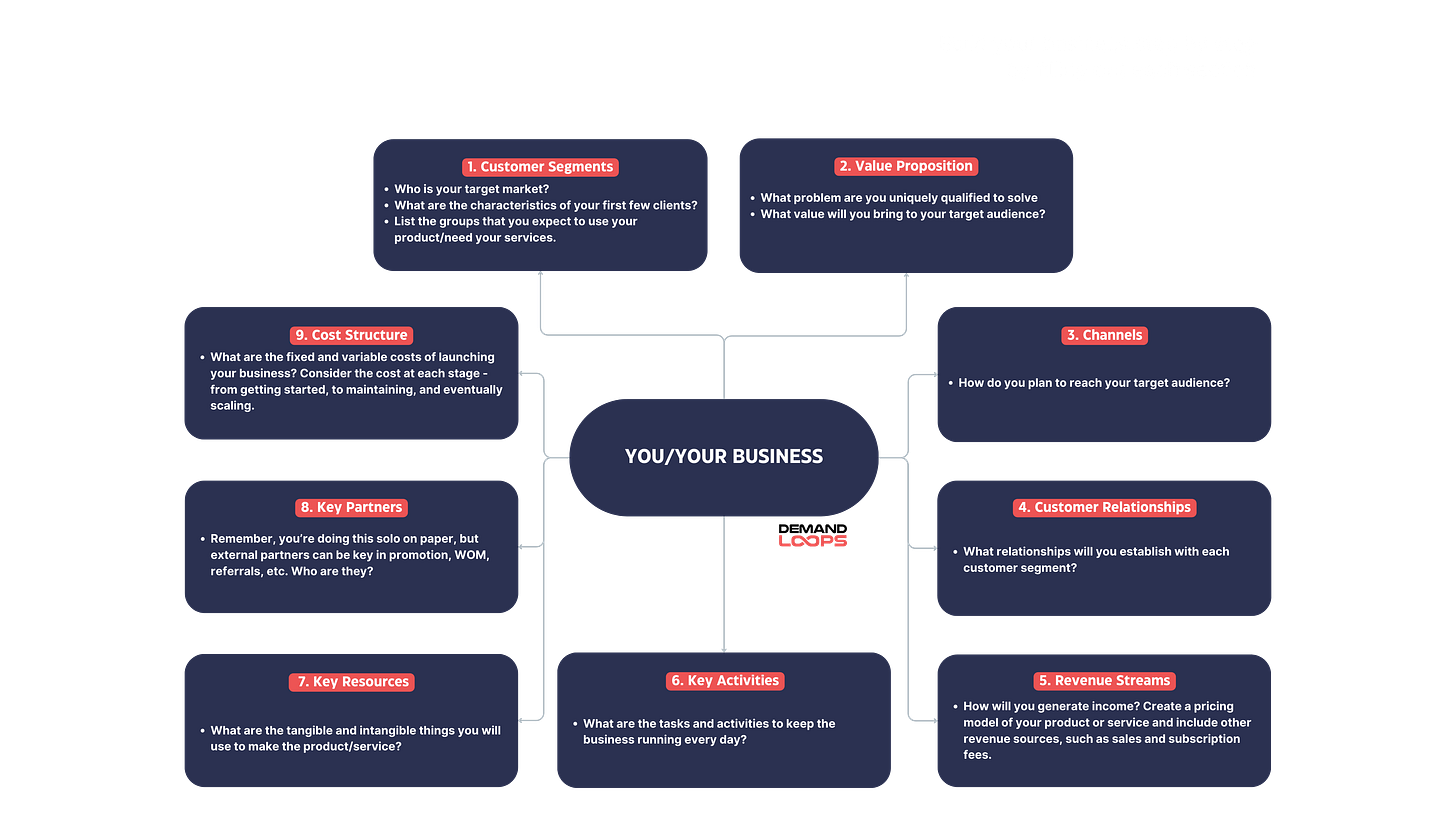

Similarly to a SaaS startup, you have to identify your Product Market Fit (PMF). This is an exercise of identifying a problem in the market that you’re uniquely positioned to solve.

I’ve built my career as a demand gen operator in B2B SaaS startups and scale ups ($0 - $100M ARR). I noticed a number of inbound requests from execs through LinkedIn seeking my expertise to help their companies build a sustainable demand engine.

The steps that followed were arguably similar to how a founder would go about growing their SaaS company.

With a few addendums that I’ve added along the way 👇

Consideration for Market Conditions and Market Acceptance.

In 2022 when I'd first thought of making the jump to solo, it was the height of the first explosion in the startup world in a while. VCs weren't funding, all performance metrics were down and to the right, and my personal finances weren't quite as bulletproofed as I felt I would need to comfortably make the leap. I'd also followed up with a few of those inbound requests that felt like the best fit and was met with a lot of "well if you want to work with us, why wouldn't you just become a W-2"...felt strange to me at the time but nonetheless the market acceptance for the type of role I'd imagined just wasn't there yet.

Building my own resume.

Now I haven't used an actual resume to land a job in years, but if I was going solo I knew I'd need a few boxes checked on my experience profile. Some of those that felt most important to me when continuing to define my PMF:

Building a demand engine from 0-1 ($1M - $22M ARR) and again at scale stage ($20M - $85M ARR)

Hiring and operationalizing a team (1 employee to 15—it was small but good enough for the market segment I knew I'd want to focus on)

Building the engine across multiple industries to ensure my skills transferred

Establishing a network.

I knew when I was ready to jump ship I didn't want to feel like I had to put on a part time Biz Dev hat to do it (this doesn't mean my way is "the" way). Absolutely nothing wrong with Biz Dev, but part of doing this alone is also recognizing your strengths, and Sales is hard.

Ripping the bandaid

All of these components finally came together in August of 2023. By this point I’d spent the better part of 3 years building my network, 6 months documenting my frameworks and templates, and 2 months side-hustling client work. I’d saved enough to validate that I could basically fall flat on my face and make zero income for 6 months and my household wouldn’t completely fall apart.

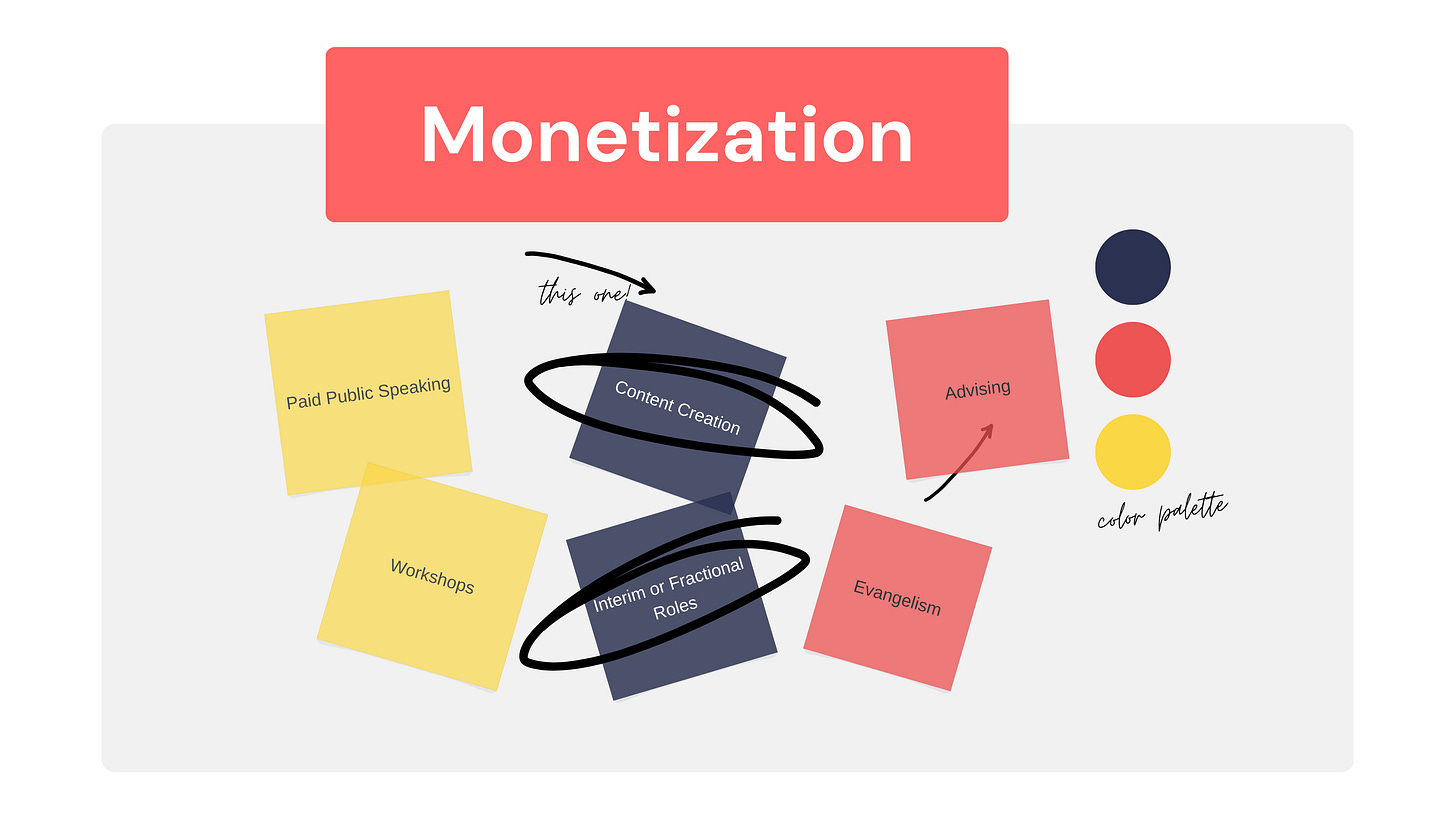

Since there are so many ways to monetize as a solopreneur, I needed to refine where my primary interests lied.

Advising and Interim felt the best suited for the key resources I’d been compiling. In July I’d worked to line up 3 clients—each meeting my PMF requirements but needing a slightly different deliverable. I used these first 3 contracts to help dial in my product(s) and pricing (an Alpha if you will). So I ripped off the bandaid and now 6 months in, I honestly can’t imagine it any other way.

This quote below sums up the balance I’m striving to strike between Interim gigs where I get the opportunity to sharpen my pencil, go in house and solve current business challenges, be held accountable to a team and OKRs vs. my advisory and writing opportunities to share my learnings more broadly.

The creative needs both the discipline and the wandering. They are essential to each other. Without experiencing life away from the art, there is no art to create. But, also, without having a routine in which to create the art, there is also no art to create. Most creative people will experience seasons of living and seasons of artistry. You need to live in order to be inspired. And you need the rituals, routines, and the loving discipline in order to bring that inspiration into something tangible, an artistic creation that can be shared with others, to allow them to glean insight into the life you’ve just experienced and the lessons you’ve brought back from your wandering. Even when your artistic life seems barren, you may be gathering inspiration. And when your artistic life becomes an obsession, let it. Life will come back to beckon you again. And so the cycle of creativity continues.

- Jamie Varon

If writings about my journey to solopreneurship interest you and you’d like to hear more, shoot me a note. I read and respond to every one of them. :)

Kaylee--totally agree that the security of a traditional FT job is largely an illusion (and self-limiting RE your thoughts on non-competes). Especially for those of us who work in A-C startups, placing a bet on a couple of companies vs. being tied down to one can feel more secure. Crucially for me, it gives me a sense of mental freedom to say what I mean, to focus on the things I'm truly great at, and limit my need for internal politicking.

I've found more and more companies amenable to fractional or project based work. Partially because it is becoming more popular and partially because there's a lot of scrutiny on the revenue per FTE ratio.

10/10